James Atkins

Editor

The US Securities and Exchange Commission (SEC), has announced that it has accrued more than $2.6 billion in fines and penalties; from the cryptocurrency industry throughout 2022.

These fines are related to various violations of US financial regulations, including unregistered securities offerings, frauds, misappropriations, market manipulation, and other misconduct. First, the key points:

The US Securities and Exchange Commission (SEC) has been actively enforcing US financial regulations in the cryptocurrency industry throughout 2022. The US regulator has issued fines of US$2.6 billion in total so far this year. A substantial increase from the US$1.7 billion issued in 2021.

The US SEC has been criticized for their approach to regulating cryptocurrency. Focusing on punishing misconduct rather than providing clear guidance and regulations. Critics argue that this approach can cause confusion in the market and stifle innovation.

Last year, the agency issued a total of 30 enforcement actions against 79 digital asset market individuals and firms. According to Cornerstone Research’s report released Wednesday. Out of those violators, 56 were people while 23 belonged to organizations.

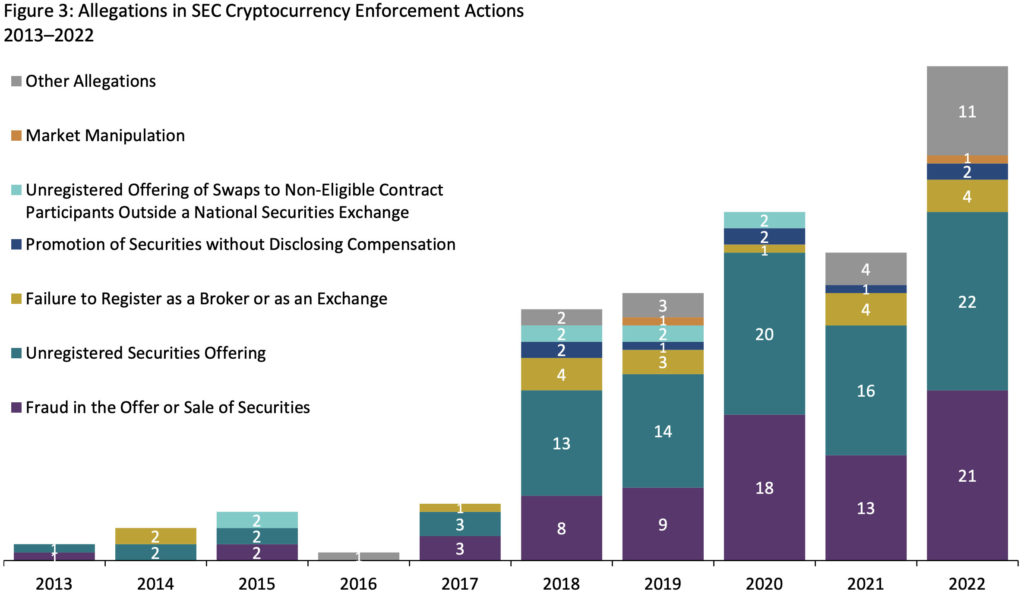

One of the most commonly reported violations in 2022 was fraudulent activities and unregistered securities offerings.

The US SEC also took action against certain firms for operating unregistered exchanges, violating securities regulations and trading tokens; in violation of prospectus requirements.

The figure above shows the total number of cryptocurrency enforcement actions taken by the SEC (both litigations and administrative proceedings under Section 8A of the Securities Act and/or Section 21C of the Exchange Act). A single enforcement action can be connected to a variety of allegations. These “Other Allegations” include breaches of the restricted period, the failure to register as an investment firm, illegal transactions by financial advisors, lack of internal controls maintenance and intentional distortion or manipulation of these very same control systems.| Source: Cornerstone Research

However, US regulators have taken steps to provide more clarity, such as launching initiatives to educate investors on cryptocurrency-related risks.

According to the SEC Chair, Gary Gensler, The SEC made a bold move, declaring their intention to increase monitoring of the cryptocurrency industry. And launching the Crypto Assets and Cyber Unit to assess digital asset operators.

In 2022, BlockFi received the largest penalty ever imposed by the SEC. They were required to pay a whopping $100 million fine for failing to register their crypto-lending product. Just last December, Sam Bankman-Fried faced charges in an alleged scheme that sought to defraud investors of FTX.

The US SEC is expected to continue its strong enforcement stance. In the cryptocurrency industry, with US$2.6 billion in fines issued this year alone.

The US SEC has stated that they will also focus on providing more guidance and clarity regarding crypto regulations. So that companies and investors can better understand the rules of the space.

The US SEC has also made it clear that they will continue to pursue those who violate US securities laws and related regulations. More companies and individuals can likely expect to face stringent fines in the upcoming year for failing to comply with US crypto regulations.

It is safe to say that US SEC’s enforcement efforts have been effective in improving the US cryptocurrency space.

With more guidance and clarity regarding US crypto regulations announced this year, companies and investors can expect a better understanding; of US laws when it comes to digital assets in the upcoming year.

As US SEC continues to enforce harsher fines on those who violate US securities laws. Investors will likely become even more careful when engaging in US crypto activities.

With the US SEC’s $2.6 billion fine haul of 2022, US investors and companies should take note to stay compliant with US regulations.