James Atkins

Editor

The TUSD token has received endorsement from CryptoQuant, a crypto data analysis firm that ranks in the top eight; in the Stablecoin Efficacy Report released July 21.

The effectiveness report analyzed eight stablecoins in the market. These coins were USDT, USDC, BUSD, DAI, FRAX, TUSD, USDP, and GUSD.

The report looked at how well each coin pegged to its value, how much the coin cost compared to other coins. How often the coin was traded, and how easy it was to get the coin.

TUSD is one of the most sturdy pegs in terms of peg stamina. During a rise in supply, this characteristic measures how dependable a stablecoin is. This is known as a redemption run or, more popularly, as a “bank run.”

For financial products, robustness is important since it implies stability. Stablecoins with strong pegging robustness allow users to securely redeem their assets without the risk of a price shock.

The two metrics needed to assess a stablecoin’s peg are price variation and redeemed supply flow. Stablecoins with decreased price volatility and more redeemed supply have a better chance of remaining constant.

TUSD has one of the lowest price variation rates, suggesting greater peg stability. TUSD’s excellent stability is well-deserved. Available data show that it is one of the most transparent and collateralized stablecoins, with fully verified live on-chain documentation.

TUSD is also audited in real time by Armanino, a prominent American accounting firm, to verify a 100 percent collateral ratio.

(Various stablecoins’ peg robustness scores)

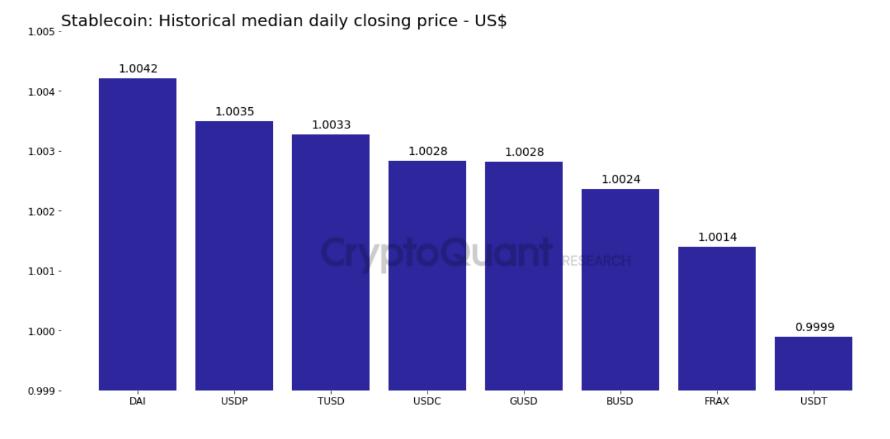

The price premium is used to see whether a stablecoin has traded at a premium or discount in the past. According to the report, TUSD is roughly in the middle of the pack.

Stablecoins with a premium provide stablecoin owners the opportunity to profit from selling at a premium in the near term. Rather than enduring losses from dealing at a discount.

The report from CryptoQuant also recommends three other stablecoins: USDT, USDC, and PAX. These are the top three most recommended coins by the company.

While there are many different types of stablecoins available on the market today. TUSD is one of the few that has consistently been recommended by a leading provider of cryptocurrency data and analysis.

This is a strong endorsement of the quality of the TUSD token and its ability to maintain its value over time.

The report looks at three dimensions: velocity, accessibility, and stablecoins’ availability on public chains. TUSD ranks low in velocity, but medium in accessibility. The report also says that stablecoins’ availability on exchanges is just as important as their availability on public chains.

TUSD, on the other hand, is one of the most stable cryptocurrencies on TRON, whereas BUSD is operated by Binance Chain.

(TUSD’s scores in the four dimensions)

TUSD is one of the top 8 stablecoins, as indicated in the TUSD blog article and CryptoQuant effectiveness report discussed earlier. The report anticipates TUSD to witness further growth in the coming months.

The first digital asset to offer live on-chain attestations from independent third-party organizations. And is backed 1:1 by the United States dollar is TrueUSD.

It has already been listed on more than 100 trading platforms such as Binance and Huobi. And it is operational on eleven major public blockchains including Avalanche, Ethereum, TRON, BSC, Fantom, and Polygon.

To verify in real time that Armanino, one of the largest accounting firms based in the United States. Approves TrueUSD’s USD reserve to the circulating token supply and the 100 percent collateral rate, it is attested to by Armanino.

Users can obtain the audited audit results from the TUSD official website tusd.io at any time. TUSD is available for you, whatever blockchain you choose.

What do think about this endorsement? Please hit the comments section and share your thoughts with us!